The British Columbia government will allow incorporated professionals and other businesses to apply for a 100 per cent rebate of PST paid between September 17, 2020 and September 30, 2021 (“Eligible Time Period”) on purchases or leases of select … [Read more...]

Just for Dentists Newsletters

Fast Tracking to Practice Ownership

Suffocating under a $300,000 student loan, most dental graduates decide to work as associates until the student debt is gone. If you really want to pay off your loan quickly, consider becoming an owner as soon as you can. Use a short-term … [Read more...]

Incorporating with Student Debt

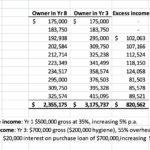

There is a general impression, particularly amongst young dentists, that there is no benefit to incorporate as long as they have personal debts. There are significant benefits for a new dentist if they spend less than they earn. Here’s an … [Read more...]

A Great Tax Shelter-Soon to Disappear

Many dentists are taking advantage of a tax strategy of converting the regular dividends from their corporations into a capital gain generating huge savings. To illustrate, the capital gains tax on $200,000 of income from the corporation is about … [Read more...]

CPP Tax Hike Hurts All Canadian Workers

The maximum pensionable earnings and contribution rate for 2021 have now been released and are a surprise to many; the cost of CPP is significantly increasing. Year Max. Pensionable Earnings ($) Employer/ee Contribution Rate (%) Max. Annual … [Read more...]

Ordinary Canadians Pay 40% of all Capital Gains Taxes

40% of Canadians who pay capital gains taxes earn less than $100,000 a year. There is a common misperception that capital gains taxes are only paid by rich Canadians. “Despite what many Canadians believe, most capital gains taxes are paid by … [Read more...]

Hurry: January 31 is deadline for the wage subsidy application

January 31, 2021 is the deadline for application of the Canada Emergency Wage Subsidy for Period 1 (based on March 2020 revenue) through to Period 5 (based on July 2020 revenue). If you would like our firm to assist you in the calculation of your … [Read more...]

The extra $20,000 CEBA loan – Think Twice before You Apply

The expanded CEBA loan program provides for a $60,000 loan, of which $20,000 will be forgiven provided the loan is repaid by December 31, 2022. Businesses and professionals that have not yet applied for the original CEBA loan will be required to meet … [Read more...]

$20,000 top up of the $40,000 CEBA loan

The federal government has officially expanded the Canada Emergency Business Account (CEBA). Starting immediately, you can get another $20,000 in loan funding on top of the $40,000 you can already access. To apply for the additional funding, … [Read more...]

The new Canada Emergency Rent Subsidy (CERS)

The Canada Emergency Rent Subsidy (CERS) was just announced, and it will replace the Canada Emergency Commercial Rent Assistance (CECRA) program. The CERS will be similar to the CECRA, as it will provide rent relief for small businesses and … [Read more...]