Building wealth is not the result of making more or having a financial whiz on your team. It is the result of spending more of your time to reach your financial goals. If your most important goal is to pay off the mortgage, or save for retirement, how much effort are you putting in to reach it? Perhaps you feel you do not have the financial expertise or you are caught up in the daily energy draining whirlwind of treating patients, with precious little time left to work on your financial plan. As the result, many dentists transfer the responsibility for their finances to someone else.

Here is our prescription of building wealth:

1. Set goals. Start by articulating your goals on paper. Financially successful dentists set their goals and implement them promptly. What are your most pressing goals right now? Paying off debt? Purchasing a family home? Financially, where do you want to be five, ten and fifteen years from now? Writing down give you a visual image and help motivate you to stay true to what you want to accomplish.

2. Project cash flow. Start by preparing personal cash flow projections for the next 12 months. They include your expected practice income, personal and living expenses, income taxes, etc. Also prepare a summary of your assets and liabilities, called the Net Worth Statement. The net worth and cash flow statements should be updated every quarter.

3. Execute your plan. Execution is the Achilles heel of financial planning because it requires you to overcome the common affliction known as procrastination. So rather than just talking about your goals, get cracking.

Start early! With their long years of education, many dentists do not start their careers until after age thirty. And although dentists’ incomes increase substantially once their career begins, a significant portion is usually needed to pay off a sizeable student debt. This means dentists will have lost many years in which they could have compounded savings. High net-worth dentists typically become serious about investing money at the beginning of their careers, not at age 50 like so many others in their profession.

4. Harness the Power of Compounding If you had to choose between a gift of $5 million today or one penny that would double in value daily for 31 days, which would you pick? If you chose the compounding penny option, you are the winner. That option would give you $10,737,418 in 31 days. That’s an offer impossible to turn down and it reflects the miracle of compounding.

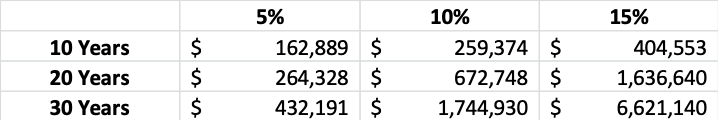

The steps to create wealth using the compounding effect are simple. Keep your spending to a minimum, start investing early, don’t lose money and put your money in investments yielding the highest returns you feel comfortable with. The Table below shows the effect of investing $100,000 at 5 per cent, 10 per cent, and 15 per cent for 10, 20 and 30 years.

The rate of return has a big impact on your investment balance. Just look at what happens if you are able to double your returns on a $100,000 investment from five to 10 per cent. Your investment will quadruple in 30 years from $430,000 to $1.75 million.

The best way to build your savings is to spend less than you do now. It is the also the most challenging, as it requires changing your habits.

John C Maxwell, a well-known author of books on motivation and leadership said: “You will never change your life unless you change something you do daily. The secret of success is found in your daily routine”.

The $4 daily latte is not a life necessity. By dropping this habit, you can save more than $50,000 in 20 years.

If you spend $100 less, it will mean a saving of $500 in 20 years, assuming an eight per cent interest rate.

If you forgo purchasing another pair of $200 Nike you don’t really need, it will save you $1,000 in 20 years. Would you purchase the running shoes for $1,000? Not very likely; but that is the true cost.

Let’s say you want to realize your dream of driving a fancy car for 100,000. Before you take the leap, consider that same amount could earn you $500,000 invested over the next 20 years. Would you purchase the car for $500,000? Of course not! So, keep in mind this is the amount you would otherwise have in your savings account 20 years from now. In 30 years the $100,000 saving will become a $1,000,000 nest egg!

The message of maximizing the compounding effect is to live frugally.

There is a saying that, “rich people buy assets and poor people buy liabilities.” It’s amazing how many dentists don’t know the difference between the two. An asset is an investment, which generates income, but items such as boats, sports cars, and vacation properties are liabilities because they require a cash outflow to maintain them. You can enjoy a great lifestyle without having to surround yourself with the newest toys on the market or living luxuriously. Delay life’s luxuries until you can afford to pay for them.