This is part two of our three-part series on planning for the increased capital gains tax.

Our last article outlined the upcoming changes to the capital gains tax. We considered whether or not you should pay that tax now at the lower 25% rate or defer it into the future at the 34% rate.

However, perhaps you’re in the second category we outlined in that article, where capital gains tax is not your biggest problem. You’d love to be able to access some of your corporate funds in order to fill up the TFSA, pay down the mortgage, plan for the acquisition of a new home or family recreational property, or simply to reduce your personal tax liability on your drawings from the company.

Perhaps that can be accomplished by realizing capital gains within your corporation.

The Capital Dividend Account

Currently, the capital gains inclusion rate is 50%, meaning you include 50% of the gain in income. The budget proposes to increase the inclusion rate to 66.67%. At the current inclusion rate, the non-taxable portion or the remaining 50% of the capital gain can be distributed to the shareholders as a tax-free capital dividend from a notional tax account referred to as the Capital Dividend Account “CDA”. After the proposed June 25th change in the inclusion rate, the tax-free capital dividends will only be 33.33% of the capital gains rather than the current 50%.

As a result, it may be worthwhile to trigger some capital gains now as the benefits may be twofold:

- you lock in the gains on your investments at the current 25% tax rate and avoid paying capital gains tax in the future at the 34% rate

- you have the ability to withdraw the 50% non-taxable portion of the capital gain from the company as a tax-free capital dividend rather than 33.33% in the future.

It doesn’t work for everyone

Accessing tax-free money sounds great but be aware it doesn’t work for everyone. Like most things, there are side effects. If you trigger capital gains income in order to access the tax-free dividends from the capital dividend account, your corporation may experience the passive income grind. We will not go into detail on the passive income grind in this article as the effect of the grind is summarized in our previous article located here: Planning for the increased capital gains tax

Generally, those wishing to access the capital dividend account can be summarized into three categories:

1 – No grind – you won’t experience the passive income grind from the realization of the capital gains income. Either you don’t have access to the small business tax rate, or the gains will not be large enough to cause your small business tax rate to be ground down below the amount you are saving in your company each year.

2 – Some grind, but recoverable – the capital gains income will cause your dental corporation’s small business limit to be ground down, but it is manageable as you can recover the increased tax through eligible dividends.

3 – Some grind and not immediately recoverable – the capital gains income will cause your dental corporation’s small business limit to be ground down and you cannot recover the increased tax through eligible dividends in the foreseeable future.

Refundable tax

In order to avoid double taxation, some of the tax on investment income is a refundable tax that is credited back to the corporation when dividends are declared to the shareholders. At the current tax rates, of the 25% capital gains tax, 15% is a refundable tax. If sufficient dividends are declared to the shareholders, the net corporate capital gain tax may be as low as 10%. However, the tax to the shareholder on the dividend may be higher than the tax recoverable by the corporation and as a result, it is not always beneficial nor easy to recover this refundable tax.

Now that we’ve set the framework, let’s have a look at a few examples:

No grind

Tom is a dental associate practising through a dental corporation. He graduated from dental school several years ago, quickly honed his dental skills, and has been generating $350,000 a year in associate income. Of the $350,000, he draws a salary of $180,000 to obtain the maximum RRSP deduction limit, and additional dividends of approximately $70,000 per year to fund family expenses. The remaining $100,000 is taxed and saved in the dental corporation. Tom has diligently accumulated a reasonable investment portfolio inside the dental corporation with accrued capital gains of approximately $150,000. Tom has a sizable mortgage but fortunately, he will enjoy paying only 2% interest on this mortgage until it matures in late 2025. Because Tom is taxed in the highest marginal tax bracket, he has been reluctant to draw any additional funds from the corporation and as a result, his TFSA is empty.

Because the increase in capital gains tax is on the horizon, Tom has come to the conclusion it would be best for him to trigger the $150,000 of capital gains and pay the tax at the current lower tax rate and also have access to the company’s capital dividend account. As a result, of the $150,000 of capital gains, $75,000 will be included in his corporation’s taxable income and $75,000 will be added to the notional capital dividend account. The $75,000 of capital gains income will grind the small business tax rate from $500,000 down to $375,000. However, fortunately, Tom does not experience any passive income grind as he is only saving $100,000 per year before tax in the corporation.

Tom files a special tax election to declare the $75,000 as a tax-free capital dividend and draws $75,000 out of the corporation to make the contribution to his TFSA.

In 2025 when Tom’s mortgage comes up for renewal, Tom will review his investment returns and mortgage renewal options and make the tough decision of whether or not he will leave the $75,000 in the TFSA or withdraw it and make a lump sum payment on the mortgage based on interest rates at that time.

The end result is Tom has $75,000 in his TFSA and only incurred an additional $15,000 in corporate tax.

Some grind but recoverable with eligible dividends

Strong markets have been good to Jennifer’s corporately held investment portfolio and she’s sitting on $400,000 of accrued gains inside her holding company. However, living expenses and private school education costs for her three children results in an extra $200,000 of drawings from the dental corporation annually, which are taxed as regular dividends at the highest marginal tax rate, leaving her with only $102,200 after tax to fund the expenses.

Jennifer heard from her colleagues that she should use the capital dividend account to covert some of her drawings from into tax free capital dividends. However, because of the sizable stock portfolio, Jennifer is concerned about the effect of the passive income grind on her corporate tax if she triggers any sizable capital gains within her corporation.

Fortunately, Jennifer’s accountant has crunched the numbers and laid out a plan for how Jennifer can benefit from the CDA.

Jennifer sells only the securities in her holding company with gains and immediately repurchases them so that she can stay invested in the market. The transaction triggers a capital gain of $400,000 of which only 50% is taxable and $200,000 is added to the notional capital dividend account. The large capital gain grinds down her small business tax rate and as a result, in her December 31, 2025, fiscal year-end her dental corporation will pay the general rate of tax of 27%. Fortunately, based on Jennifer’s income the additional corporate tax from the loss of her small business deduction is recovered by her corporation declaring eligible dividends to her rather than regular dividends.

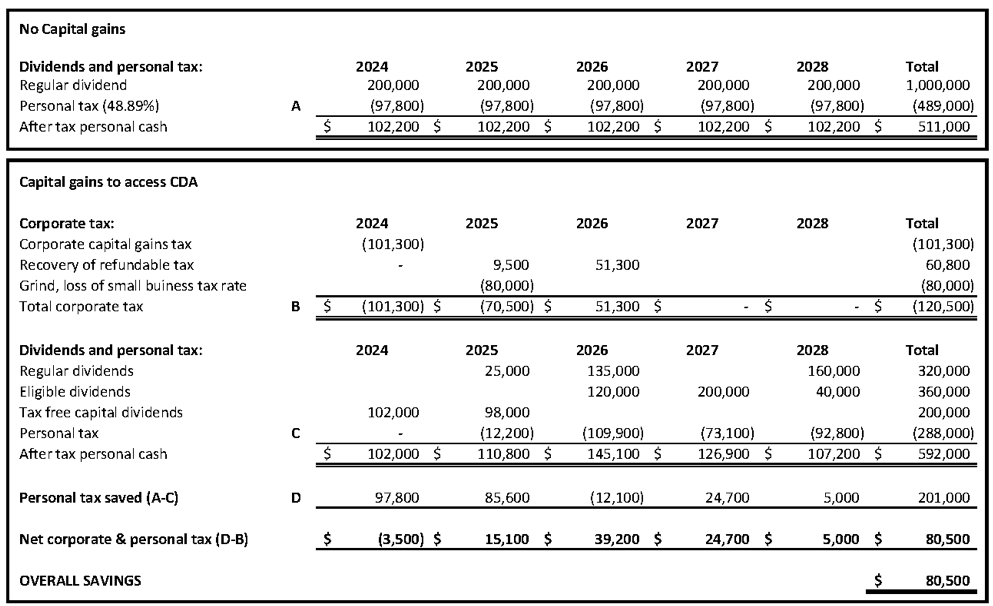

However, the savings from the $200,000 tax-free capital dividends are not immediately felt in her cash flow. While Jennifer does save the personal tax in 2024, the transaction does trigger corporate capital gains tax almost equivalent to the personal tax saved on the tax-free capital dividend. Still, the combination of the tax-free capital dividend and eligible dividends results in overall tax savings in years 2025 through 2028 inclusive with her income tax returning to almost a normal level in 2028 as illustrated in the table below:

Providing there are no significant legislative tax changes over the next few years affecting Jennifer’s plan, her overall savings of paying the tax on the capital gains now is $80,500 and she also gets to take advantage of paying 25% tax now rather than paying 34% capital gains tax in the future!

Grind and eligible dividends not currently recoverable

Paul started his endodontic practice in a corporation many years ago. He was fortunate to pay off his mortgage in the early years of his career and being debt-free allowed him to accumulate a significant investment portfolio within a holding company. However, his recent acquisition of the family cottage has resulted in a large personal mortgage that he would really like to eliminate. His buy-and-hold strategy in the stock portfolio has allowed the portfolio to accrue significant gains of $300,000 and also allowed Paul to avoid too much of the passive income grind in the dental corporation.

Because Paul didn’t have a mortgage, he’s made significant savings in his holding company. His corporate income has been well in excess of the $500,000 small business tax rate many times over the years. As a result, his dental corporation has paid the 27% general rate of tax and he has accumulated a pool of eligible dividends in the companies that could be declared to him out of the corporate income.

In light of the looming capital gains tax rate proposals, Paul meets with his financial planner who suggests he should check with his accountant, but perhaps he should trigger the capital gains within his corporation so that he can access the capital dividend account before the rates change, allowing him to make a lump sum payment on the cottage mortgage. Excited about the opportunity to pay down his debt, Paul calls his accountant.

Unfortunately, Paul’s accountant advises if he triggers the $300,000 of capital gains within his holding company, his dental corporation will experience the passive income grind which will cause him to lose the 11% corporate tax rate on his first $500,000 of income and pay the 27% corporate rate instead for the following year. The extra 16% on $500,000 would result in Paul paying $80,000 in additional corporate tax. As a result of the gain, Paul would have access to $150,000 of tax-free CDA. However, this $150,000 tax-free CDA could have normally been distributed as an eligible dividend, the tax rate of which is only 36.54% or approximately $55,000. As a result, Paul would be paying an additional $80,000 in corporate tax and only receiving $55,000 in personal tax savings.

Like Jennifer, Paul can recover the additional corporate tax paid in the form of lower personal tax when he extracts eligible dividends from his corporations in the future. However, unlike Jennifer, Paul has a significant pool of eligible dividends already available and continues to generate income by adding to the eligible dividend pool. As a result, the recovery of this additional corporate tax would be many years down the road, likely into retirement.

Summary

The changes in the capital gains tax will affect everyone differently. Before you act, ensure you understand how the proposals will affect you and analyze whether or not you should take action before the new capital gains tax rates come into effect.

Stay tuned, more to follow on how to plan for the gains on your real estate holdings…