If you had to choose between a gift of $5 million today or one penny that would double in value daily for 31 days, which would you pick? If you chose the compounding penny option, you are the winner. That option would give you $10,737,418 in 31 days. That’s an offer impossible to turn down and it reflects the miracle of compounding.

The steps to create wealth using the compounding effect are simple.

Keep your spending to a minimum, start investing early, don’t lose money and put your money in investments yielding the highest returns you feel comfortable with.

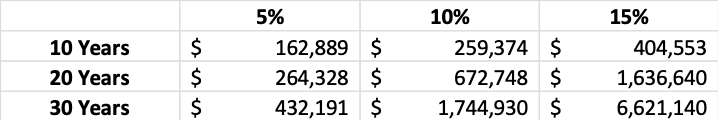

The Table below shows the effect of investing $100,000 at 5 per cent, 10 per cent, and 15 per cent for 10, 20 and 30 years.

The rate of return has a big impact on your investment balance. Just look at what happens if you are able to double your returns on a $100,000 investment from five to 10 per cent. Your investment will quadruple in 30 years from $430,000 to $1.75 million.

The best way to build your savings is to spend less than you do now. It is the also the most challenging, as it requires changing your habits.

John C Maxwell, a well-known author of books on motivation and leadership said:

“You will never change your life unless you change something you do daily. The secret of success is found in your daily routine”.

The $4 daily latte is not a life necessity. By dropping this habit, you can save more than $50,000 in 20 years.

If you spend $100 less, it will mean a saving of $500 in 20 years, assuming an eight per cent interest rate.

If you forgo purchasing another pair of $200 Nikes you don’t really need, it will save you $1,000 in 20 years. Would you purchase the running shoes for $1,000? Not very likely; but that is the true cost.

And let’s say you are a 50-year-old dentist and want to realize your dream of driving the ultimate sports car, a $200,000 Porsche. Before you take the leap, consider that same amount could earn you $1 million invested over the next 20 years. Would you purchase the Porsche for $1 million? Of course not! So, keep in mind this is the amount you would otherwise have in your savings account 20 years from now.