Many dentists are taking advantage of a tax strategy of converting the regular dividends from their corporations into a capital gain generating huge savings.

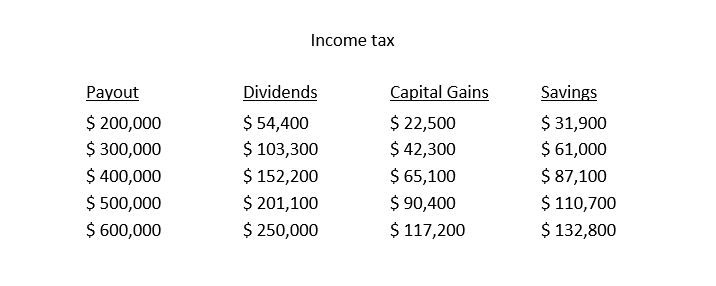

To illustrate, the capital gains tax on $200,000 of income from the corporation is about $22,500, compared to a tax of $54,400 on dividend income. A tax saving of nearly $32,000! If you double the income to $400,000, the dividend tax is $152,200 while the capital gains tax is $65,100. A saving of over $87,000! As you can see in the table below, the more you take, the more you save.

The capital gains method of removing funds allows you to reduce your personal taxes on funds you need for living expenses, make a lump sum payment on your mortgage, or finance the children’s education.

Our fees to set up the capital gains strategy start at $2,500.

It is smart to plan your personal taxes for 2021 now. It is anticipated that an upcoming Federal Budget could either bring about legislative changes or increased capital gains inclusion rates that may end the advantage of the capital gains strategy going forward. Therefore, take advantage before it disappears. Tax saving opportunities that good will not be around for long!